Now Available!

Get your copy of the 7th Annual State of Smart Manufacturing and hear from 300+ manufacturers in this new survey report!

Subscribe to Our Blog

For a monthly digest of expert insights, data points, and tips like the ones in this article.

Unique Data Set Contextualizes COVID-19 Impact on Manufacturing

COVID-19 (Coronavirus), Manufacturing Intelligence, Big Data

A mere week ago, the World Health Organization declared the coronavirus (COVID-19) outbreak a pandemic. In the weeks leading up to and following this announcement, governments, organizations, and businesses (including us here at Plex Systems), have taken measures to not only reduce the spread and impact of the coronavirus for the health and safety of the communities we live and work in, but also to ensure continued access to the medicine, food, supplies, and other goods that we depend on.

Manufacturers play a key, often unnoticed role when the world faces a crisis of this magnitude. This group is responsible for making sure we have access to toilet paper, baby formula, and pasta (just to name a few things that flew off the shelves in the U.S. this week alone).

Manufacturers also make sure products that can help those most acutely affected by coronavirus, like respirators and ventilators, are produced in increased quantities to meet demand. They make sure the trucks responsible for delivering these items have access to dependable wheels that keep them on the road and on time. And they make sure there are enough hand sanitizer stations to install in hospitals, urgent cares, grocery stores, and pharmacies the world over.

All of this has to happen 24/7, without disruption. Manufacturers are responding to the challenges related to the pandemic with incredible resilience, innovation, and planning. Just consider the producers of Don Q Rum, the Serrallés family. The award-winning rum maker noticed there were supply shortages due to the virus, and took steps to begin producing ethyl alcohol for free distribution to hospitals and healthcare providers in Puerto Rico.

Beyond the efforts of these individual leaders, at a macro level, we are seeing a broader story developing regarding how manufacturers globally are responding to this crisis.

Because Plex Systems solutions are cloud-based, we have access to 20 years of anonymized, compiled operational data from the approximately 700 manufacturers we serve. This group collectively runs 1,200 active production facilities in 29 countries, representing the aerospace, automotive, fabricated metals, food and beverage, industrial machinery, and plastics and rubber industries. For scale, in the fourth quarter of 2019 alone, this group collectively processed over 1.4 million shipments. Daily, they record upwards of 8 billion transactions (such as barcode scans, moved inventory, shipments, etc.).

Based on the activities within this specific data set, we can provide meaningful insight on the scope and impact of the pandemic as it applies to these manufacturers, and better contextualize the large-scale implications. And we’d like to share that with you.

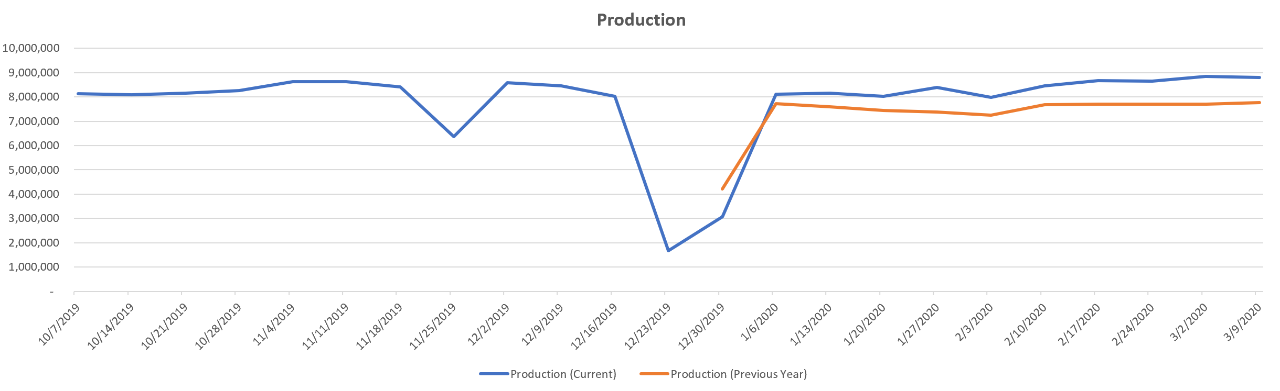

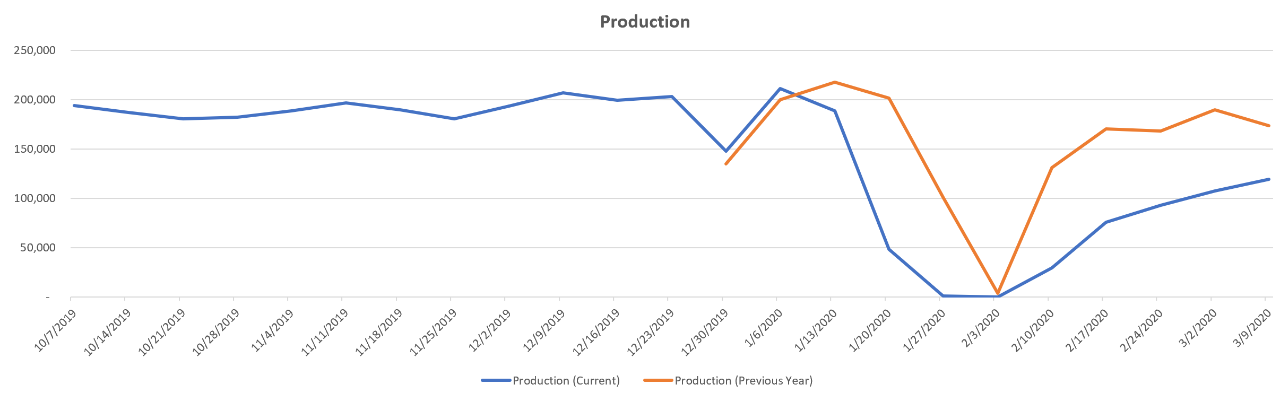

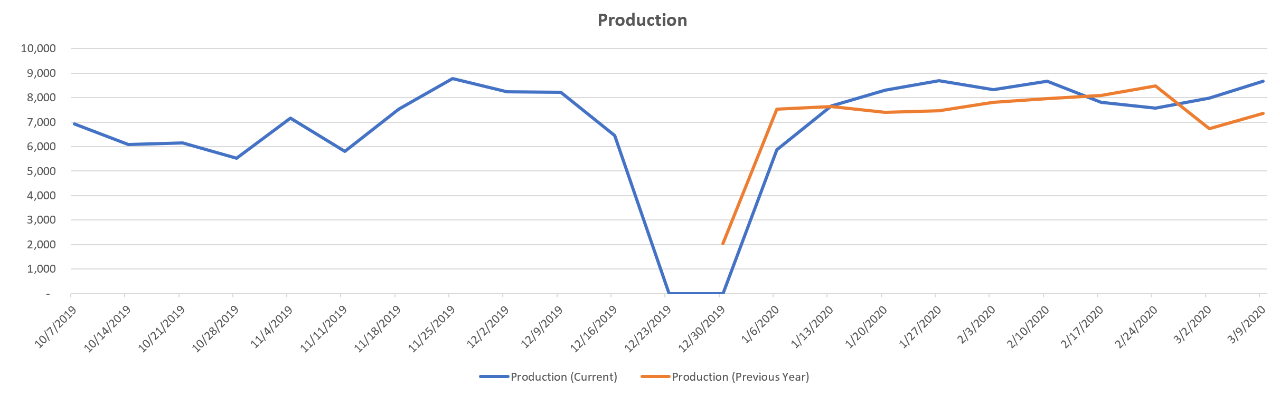

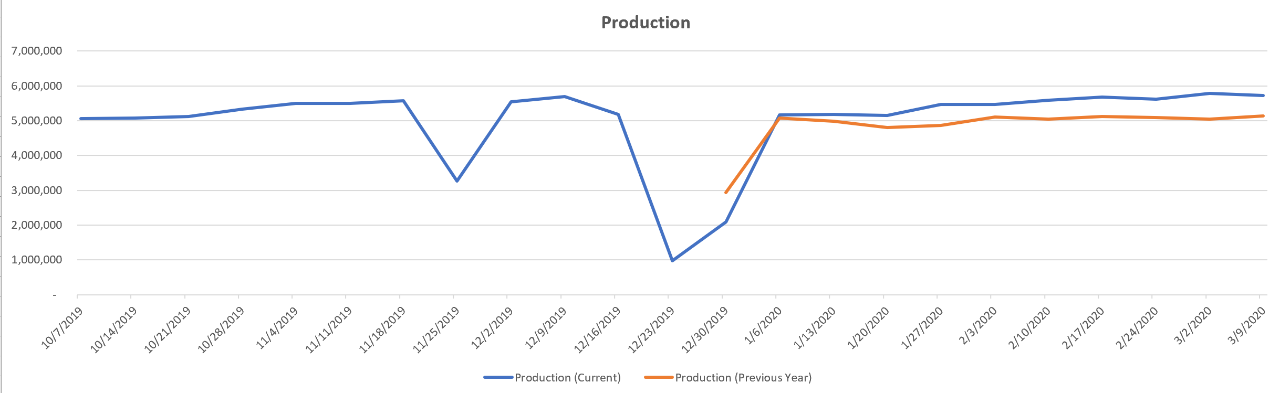

First we’ll look at one key manufacturing indicator: Production transactions, initially laying this data over part of 2019 to demonstrate the change year-over-year. Keep in mind that more facilities were added in 2020, so it’s not necessarily important to look at the absolute number of transactions but rather the relative shape of the curves year-over-year. For reference, the blue line represent recent data from late 2019 until the present, while the orange line reflects data from last year.

To start, we are providing a baseline of the global community, followed by data from three specific countries currently being monitored closely in the news: China, Italy, and the U.S. For context, China put quarantines in place in early February after first seeing cases emerge in January. Italy put quarantines in place March 9. As of this writing, the U.S. is encouraging self-quarantine and social distancing, with one containment zone implemented a week ago and the state of California ordering all residents to stay at home. Note this data reflects two periods of activity to compare year-over-year trends: the blue trend line is production transactions from October 1, 2019 to March 15, 2020 and the orange trend line indicates production transactions from December 30, 2018 to March 15, 2019.

Global Data Set:

China Data Set:

Italy Data Set:

United States Data Set:

What does this tell us so far?

- China, which saw dips around the holidays and during Chinese New Year, around the same time the quarantine went into effect, has gradually seen production increasing. This is consistent with news outlets reporting that factories are gradually reopening, with caution. Local manufacturers that we spoke with are also back up to nearly pre-quarantine levels but are still enforcing health and safety standards to prevent a second wave of infection. This could serve as a model for the way other countries will respond.

- Italy began to see a drop in production in mid-February, followed by an uptick in activity. This growth could possibly be attributed to manufacturers preparing for an impending shutdown, assuming Italy would follow the lockdown trajectory of other impacted countries. It will be interesting to see how the country progresses, as cases of coronavirus are emerging exponentially.

- The U.S. is holding steady when compared to 2019 trends; just in the past week seeming to slope downward. With yesterday’s announcement that GM, Ford, and Fiat Chrysler shuttering U.S. plants, similar to Honda and BMW’s U.S. and Europe closures, we anticipate this data could look very different a week from now.

This data also reinforces the findings of a March 9 survey conducted by the National Association of Manufacturers (NAM) that 53% of manufacturers are anticipating a change in operations.

So what’s next?

Stopping the spread of the virus, and the depth of its impact, remains our first and most important priority. We’re watching global events unfold and change nearly by the hour, and like you, are focused on aiming our collective efforts to flatten the curve for the health and safety of the communities we live and work in.

As we experience and understand the broader global impact, Plex Systems will help lend insights and bring you regular updates based on the experiences of 700 global manufacturers, along with personal stories from individual businesses and experts in an effort to help manufacturers adapt and respond to these unprecedented and turbulent times.

Have any specific questions you’d like us to help answer? Email us at krebella@plex.com.

Graphs for all countries and key findings were updated on March 24, 2020 to reflect data currently available as of March 23, 2020. These graphs and renewed findings indicate our production data was underreported in an earlier edition.