Now Available!

Get your copy of the 7th Annual State of Smart Manufacturing and hear from 300+ manufacturers in this new survey report!

Subscribe to Our Blog

For a monthly digest of expert insights, data points, and tips like the ones in this article.

Manufacturing Production Holds Steady While Automakers Plan to Reopen

Big Data, COVID-19 (Coronavirus), Manufacturing Intelligence

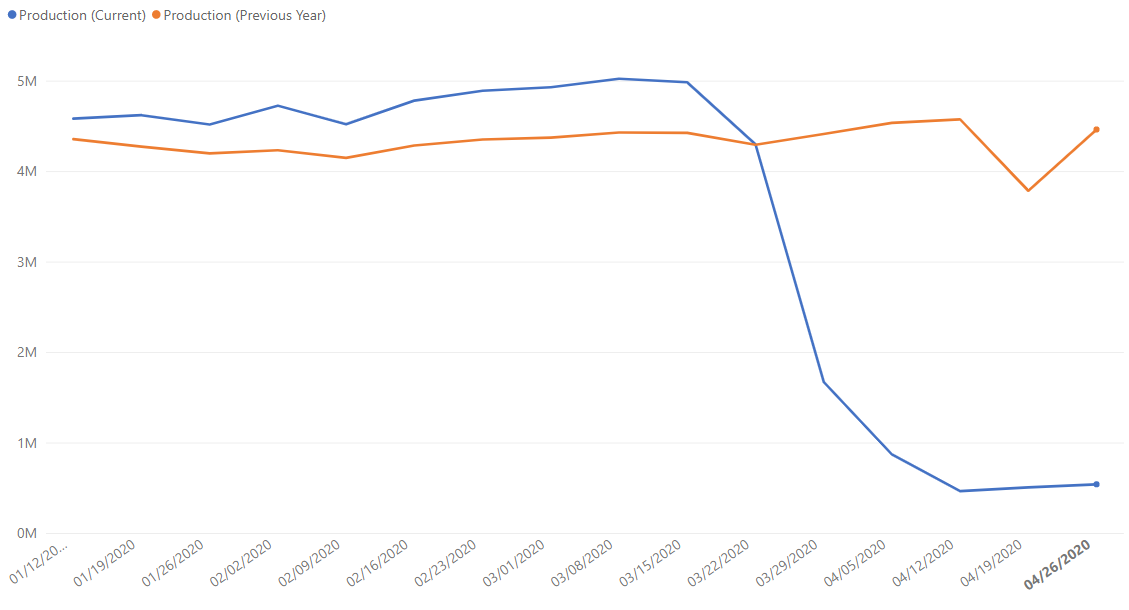

Declining manufacturing production turned a corner last week – starting to flatten in most regions around the globe – and seems to be holding steady according to our most recent data.

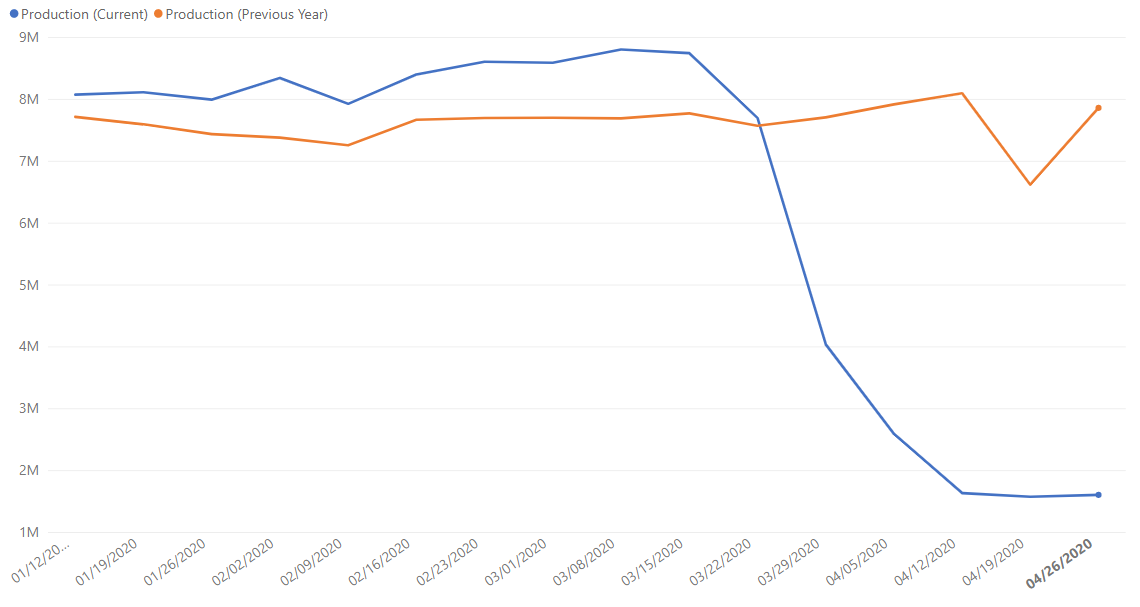

Global data set

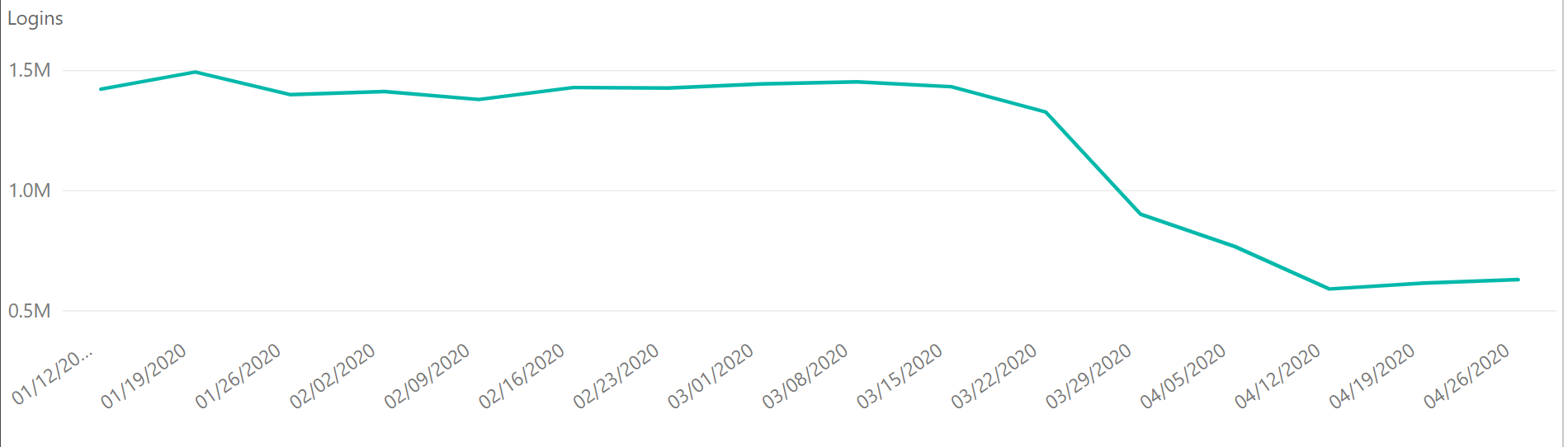

Global manufacturing production has remained flat since last week, indicating that we are still seeing a view of what is considered “essential.” It is interesting to note that despite the low level of production, manufacturers included in this data, which all rely on a cloud-forward strategy, continue other important front-office and back-office activities such as accounting, sales, payroll, etc. as represented by system login data. Current login activity (see chart below) is still tracking at 45% of pre-crisis levels, despite production activity dropping to approximately 20%. As an example, Inteva Products, a leading global automotive supplier of engineered components and systems, was able to leverage their cloud applications to transition 90% of their office and field operations to home based work during the recent shut down, according to a recent conversation in Deal Architect.

Plex Smart Manufacturing Platform login activity

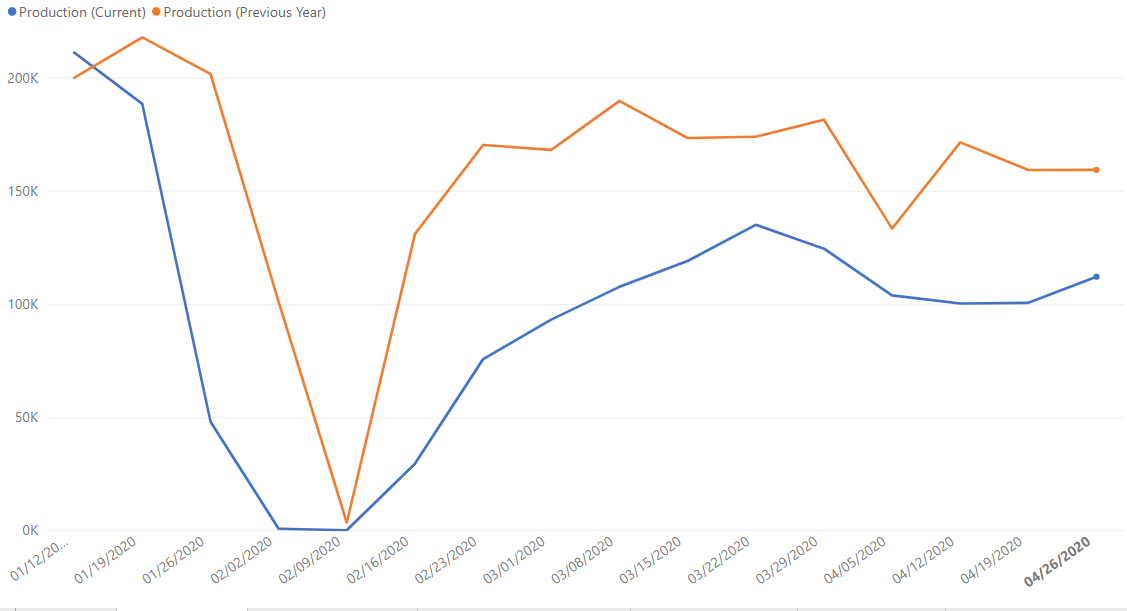

China data set

China saw a slight uptick in activity last week after a brief dip in production. As manufacturers that rely on supply chains within China slowly come online around the world, this number should increase. It remains to be seen, however, whether China will return to pre-virus production levels. Reshoring or supply chain redundancy efforts companies are considering or putting in place to mitigate the risk from future crises of this scale may affect the country’s resurgence. However, cost and competitive issues must still be factored into long-term decisions and addressed through various means, such as maintaining tariffs, tax breaks, etc.

Additionally, consumer behavior in China is shifting which will impact manufacturing. Many Chinese consumers are no longer buying cars: based on recent survey findings published by Automotive News, nearly two-thirds of respondents who had intended to buy new vehicles before the pandemic hit are now postponing those purchases.

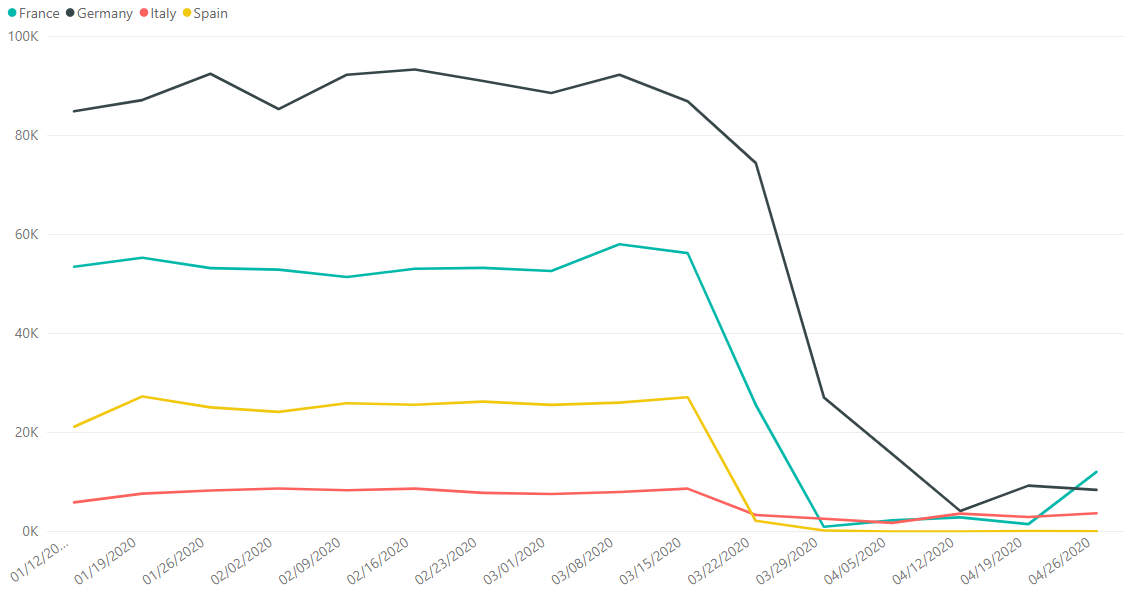

France, Germany, Italy, Spain 2020 data set

France, Germany, and Italy are seeing inconsistent recovery patterns, while production in Spain remains at near-zero. As more plants come online due to automaker activity, combined with plans to begin lifting lockdown restrictions in Italy, France, and Spain, it will be interesting to see if and how manufacturing activity will increase, and if it will do so consistently. Keep in mind that because these data sets are relatively small, they may reflect individual industry recovery patterns more specifically than country-wide manufacturing recovery trends.

What’s Next: All Eyes on Auto, then the World

Global automotive data set

Global automotive production has remained steady, but with automakers reopening or preparing to reopen plants this week (such as Volkswagen, which reopens Europe's largest car factory this week after a coronavirus-related shutdown) and Ford Motor Company in the U.S. recalling skeleton crews to prepare for reopening efforts, we expect to see activity in the next few weeks increase quickly as automotive supply chains are similarly re-activated. The Mexico government also said last week it plans to reopen automotive factories in conjunction with the U.S. and Canada.

More broadly, now that we have seen a few weeks of stability, and even some rebound, we remain cautiously optimistic while monitoring broader trends. Long-term market rebound and future production levels are uncertain at this time. If China is any indication, changing demand is evolving, and the full impact of these changing buying behaviors will play out over time.

Details on the Data Source & How to Interpret Graphs

Plex Systems solutions are cloud-based, giving us access to 20 years of anonymized, compiled operational data from the approximately 700 manufacturers we serve. This group collectively runs 1,200 active production facilities in 29 countries, representing the aerospace, automotive, fabricated metals, food and beverage, industrial machinery, and plastics and rubber industries. For scale, in the fourth quarter of 2019 alone, this group together processed over 1.4 million shipments. Daily, they record upwards of 8 billion transactions (such as barcode scans, moved inventory, shipments, etc.).

Note this data reflects two periods of production activity to compare year-over-year trends: the blue trend line is production transactions from January 1, 2020 to April 26, 2020 and the orange trend line indicates production transactions from January 1, 2019 to April 26, 2019 (see x-axis, with dates noting the end of the tracked week). Keep in mind that Plex customers added more facilities in 2020, so it’s not necessarily important to look at the absolute number of transactions (see Y-axis) but rather the relative shape of the curves year-over-year. Login data reflects activity from January 1, 2020 to April 26, 2020. There is a margin of error of +/- 2%.

A note on April data: Most graphs above indicate a steep drop in activity in April in 2019. This decrease indicates the annual drop in production around the Easter holiday, including Good Friday. You’ll note this did not occur as dramatically in 2020, likely due to most production activity already being at rates considered essential.